Y Online Sbi

Posted : admin On 4/9/2022© State Bank of India. Site best viewed at 1024 x 768 resolution in I.E 10 +, Mozilla 35 +, Google Chrome 35 +.

Y Online Gateway

Tips to protect against Online Fraud and Phishing Variations

- Maintenance Mode. YONO is undergoing maintenance. Sorry for the inconvenience. We will be back by 06:55 AM. Thank you for your patience.

- Dear Customer, As an enhanced protection to your account, we have introduced two factor authentication. To know more click here. YONO SBI UK click here.

- SBI Flexipay Home loan provides an eligibility for a greater loan. It offers customer the flexibility to pay only interest during initial 3-5 years and thereafter in flexible EMIs. This variant of SBI.

- Saving Bank Account - Open an online saving bank account with SBI. Get mobile & internet banking features with SMS alerts. Bank anywhere using the YONO app.

Do not share any confidential information through suspicious emails, websites, social media networks, text messages or phone calls.

Report It

If you receive one of these suspicious e-mails:

Report it to or the institution that it appears to be from.

If you received one of these suspicious e-mails and you unwittingly provided personal information or financial information, follow these steps:

Protecting You Online

At STATE BANK OF INDIA we use the highest industry standard for security. And we constantly review it to counter any new security threats.

Here are some of the steps we take to protect you while you’re banking online.

When you login:

While you're banking online:

When you're finished:

Security experts at SBI behind the scenes

Safe Online Banking

Select a suitable password.

Always protect your password

Enable our SMS based One Time Password

Remember to logout

Check that the website is secure

Be careful with emails

Secure your computer

Features for Safe Online Banking

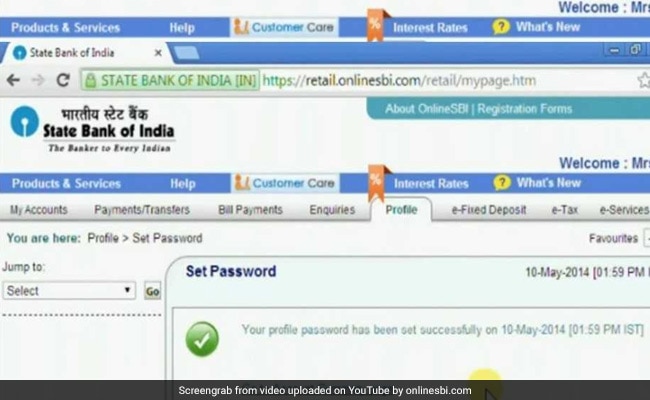

OnlineSBI provides several inbuilt features for safe and secure banking. You can use the security options in the profile tab to:

Customize your Personal Profile

You can set your display name, mobile number and email ID in your personal profile. The display name is used in the Welcome message.

Manage Third Party

You can define your own trusted third parties to whom you wish to transfer funds. You can also add, delete or modify your list of trusted third parties.

Define Limits

You can set limits for demand draft and third party transfers, in the profile section. It is advisable to set a lower limit. You can enhance the limit as and when required.

Enable High Security

SMS based high security is an additional layer of security provided for your transactions. It is recommended that you enable this feature, in the profile section. Whenever you transfer funds to own or third party accounts, issue a demand draft or credit funds to a PPF account you will receive a high security password by SMS. You need to use this password to complete the transaction.

Types of Online Fraud and Phishing Variations

Phishing Email and Fraudulent websites

Phishing is a general term for e-mails, text messages and websites fabricated and sent by criminals and designed to look like they come from well-known and trusted businesses, financial institutions and government agencies in an attempt to collect personal, financial and sensitive information. It’s also known as brand spoofing. If you should ever receive an email that appears to be suspicious, do not reply to it or click on the link it provides. Simply delete it. To report a suspicious email that uses SBI’s name, you can report to us immediately at . You can read more about Phishing here.

Popup windows/advertisements

Pop-ups are the advertisements that 'pop up' in a separate browser window. When you click on some of these pop-ups, it's possible that you're also downloading 'spyware' or 'adware.'

Vishing

Vishing is the criminal practice of using social engineering and Voice over IP (VoIP) to gain access to private, personal and financial information from the public for the purpose of financial reward. The term is a combination of 'voice' and phishing.

Scammers randomly dial phone numbers using an automated system or a real human being pretending they are calling on behalf of Bank/financial company asking you to update information regarding your, bank accounts, Card details etc. because there is a problem on your account or they may also say that they have made some upgrades into their system.

Smishing

Smishing is a form of criminal activity using social engineering techniques similar to phishing. Smishing victims receive SMS messages. Known as 'smishing,' these text messages might ask a recipient to register for an online service -- then try to sneak a virus onto the users' device. Some messages warn that the consumer will be charged unless he/she updates his/her personal or financial credentials in a Web site that then extracts such information and other private data.

Key logging

Unwanted Key-Logging software can record everything that is typed on a computer and send the information to an outside party. Key-Logging 'Spyware' or 'Adware' often infects a computer via a virus attached to an e-mail or other type of download.

State Bank of India never sends email to obtain customer information. Please report immediately if you receive any e-mail purported to be originated by State Bank of India to provide your Username or Password or any other personal information. This may be a phishing mail.

Please ensure the following before logging in

URL address on the address bar of your internet browser begins with 'https'; the letter’s’ at the end of 'https' means 'secured'. Look for the padlock symbol either in the address bar or the status bar (mostly in the address bar) but not within the web page display area. Verify the security certificate by clicking on the padlock. The address bar has turned to green indicating that the site is secured with an SSL Certificate that meets the Extended Validation Standard. Do not enter login or other sensitive information in any pop up window.

Beware of Phishing attacks

Phishing is a fraudulent attempt, usually made through email, phone calls, SMS etc seeking your personal and confidential information. State Bank of India or any of its representatives never sends you email/ SMS or calls you over phone to get your personal information, password or one time SMS (high security) password. Any such e-mail/SMS/ phone call may be an attempt to fraudulently withdraw money from your account through online banking. Never respond to such email/SMS/phone call. Please report immediately on report.phishing@sbi.co.inif you receive any such email/SMS/phone call. Immediately change your passwords if you have accidentally revealed your credentials.

IMPORTANT SECURITY TIPS FOR SAFE ONLINE BANKING

1.Access your bank website only by typing the URL in the address bar of your browser.

2.Please do not use your personally identifiable information SSN, ATM Card number, Bank Account Number etc. as your user id or password.

3.Do not click on any links in any e-mail message to access the site.

4.State Bank of India never sends e-mail and embedded links asking you to update or verify personal, confidential and security details. NEVER RESPOND to such e-mails/phone calls/SMS if you receive them.

5.Do not be lured if you receive an e-mail/SMS/phone call promising reward for providing your personal information or for updating your account details in the bank site.

6.Having the following will improve your internet security:

a.Newer version of Operating System with latest security patches.

b.Latest version of Browsers supporting Extended Validation Standard for SSL certificate.

c.Firewall is enabled.

d.Antivirus signatures are applied.

7.Scan your computer regularly with Antivirus to ensure that the system is Virus/Trojan free.

8.Change your Internet Banking password at periodical intervals.

9.Always check the last log-in date and time in the post login page.

10.Avoid accessing Internet banking accounts from cyber cafes or shared PCs.

Our website usa.onlinesbi.com is EV-SSL certified

Sbi Bank India

What is Extended Validation SSL?

Sbi Bank Account Opening Online

Extended Validation SSL Certificates give high-security web browser information to clearly identify a website's organizational identity. For example, if you use Microsoft® Internet Explorer 9 and above to visit a website secured with an SSL Certificate that meets the Extended Validation Standard, IE will cause the URL address bar to turn green. A display next to the green bar will toggle between the organization name listed in the certificate and the Certificate Authority (VeriSign, for example). Similar features are available in the latest version of Browsers supporting Extended Validation Standard for SSL certificate